The Problem:

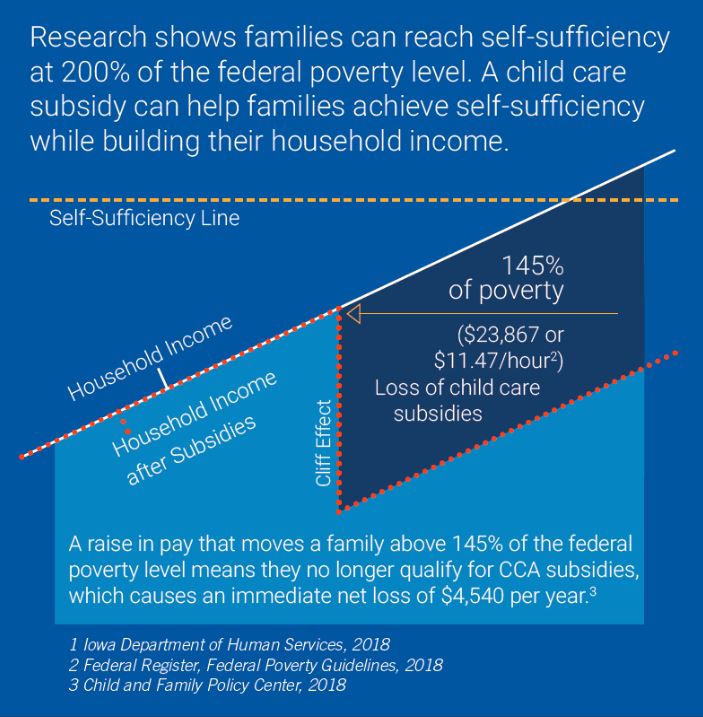

Some welfare recipients are trapped in a poverty cycle from increased income pushing off the cliff of reduced benefits.

Image source: United Way of Central Iowa

The Solution:

Create a stair-step reduction of benefits instead of a cliff.

The Welfare Cliff Effect

Childcare subsidies exist to bridge the gap between income and expenses for working families. Workers relying on childcare assistance reach a “cliff” where a slight increase in income disqualifies them for services worth substantially more than their pay raise.

Individuals trying to work their way out of poverty struggle because benefits are reduced faster than their wages increase. This is particularly true for single parents relying on government assistance for childcare costs. Trapping people in a cycle of poverty is unfair for individuals trying to work their way out of their situation and off public assistance. It’s also costly for taxpayers, as individuals who could become net tax contributors are stuck in a cycle of being net recipients of tax dollars.

Creating a stair-step system to help people work their way out of poverty would help address the shortfalls in current public assistance programs. People should ultimately be financially better off by working and earning more money. Putting workers in a position where a raise could mean losing the ability to afford a rent payment is not a situation anyone should have to face. Creating a path for people to work their way out of poverty should ultimately reduce public assistance costs as more individuals become financially independent and no longer need government assistance.

Pennsylvania's Solution:

Require child care subsidy co-payments to be calculated based on a percentage of the adjusted gross income (AGI) of a family, taking into account federal poverty levels (FPL).

Co-payments for child care start at a minimum of $5 per week and don’t exceed:

- 8% of AGI for those 100% or less of FPL

- 11% of AGI for those between 100% and 250% of FPL

- 13% of AGI for those between 250% and 275% of FPL

- 15% of AGI for those between 275% and 300% of FPL

Child care co-payment reduction incentives encourage increasing the family’s AGI by working additional wage-earning hours:

- 0.75% reduction for at least 25 wage-earning hours per parent

- 1.5% reduction for at least 30 wage-earning hours per parent

- 2.25% reduction for at least 35 wage-earning hours per parent

- 3% reduction for at least 40 or more wage-earning hours per parent