Constitutional Protections

March 30, 2019

The Problem:

The threshold for raising taxes on hardworking Iowans is too low.

ITR Solution:

Requiring a two-thirds majority vote by the Legislature to raise income taxes is a commonsense protection that puts taxpayers before the noisy special interests that are constantly asking for a bigger piece of their paychecks.

What Has Happened:

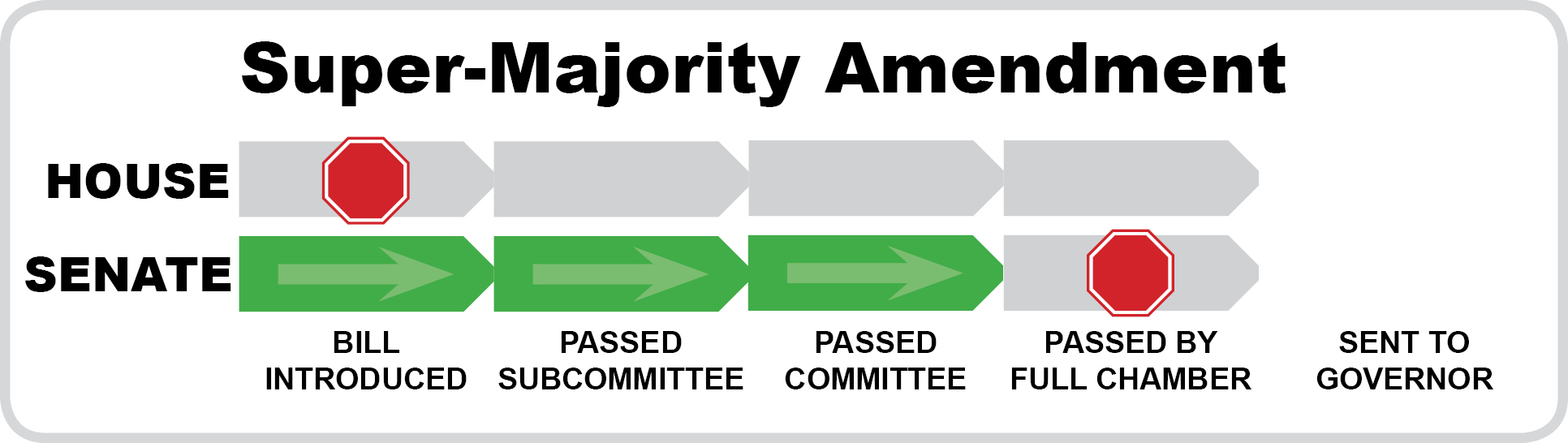

A joint resolution advanced through a Senate subcommittee and committee. The House did not take action on this resolution.

Work Left to Do:

Remind legislators who is paying the state's bills (YOU!), and ask for their support for a resolution requiring a super-majority vote to raise your taxes.

The Problem:

Because Iowa's 99% spending limit only exists as a statute, a future legislature could simply pass a new statute that further weakens this limit or removes it altogether.

ITR Solution:

A constitutional amendment would be the strongest way to control the growth of government and future spending.

What Has Happened:

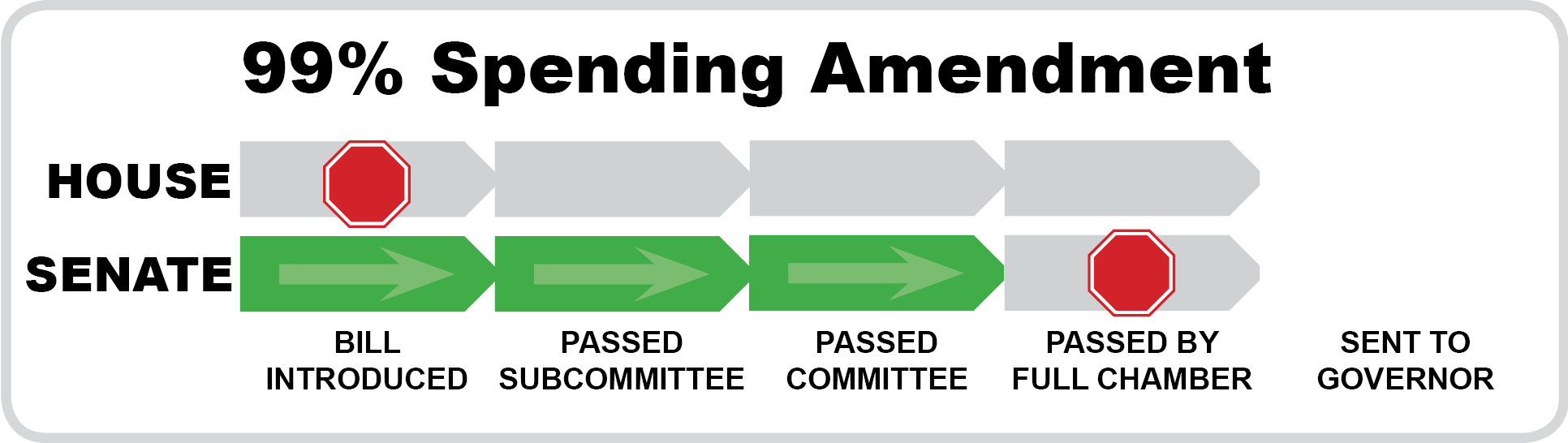

A joint resolution advanced through a Senate subcommittee and committee. The House did not take action on this resolution.

Work Left to Do:

Tell lawmakers to give Iowa permanent spending protection by supporting the 99% spending limit amendment.

Stay Informed. Join ITR!

Taxpayers Need Permanent Protection

“How can the state stop spending so much money?” This is a common question asked across Iowa. While there are many ways this could be accomplished, one of the broadest solutions would be to strengthen the existing spending limitation that exists in Iowa by adding language to our state’s constitution.

The Iowa legislature is restricted to spending 99 percent of the revenue they collect each year. Because this limit only exists as a statute, a future legislature could simply pass a new statute that further weakens this limit or removes it altogether. A constitutional amendment would be the strongest way to control the growth of government and future spending.

Since spending and tax limitations can take various forms, Matthew Mitchell, a senior fellow at the Mercatus Center, contends that the most effective solution will have the following characteristics:

- A spending limitation formula based on the sum of inflation plus population growth.

- Be based upon spending rather than revenue.

- Require a supermajority rather than a majority to be overridden.

- Would immediately refund revenue collected in excess of the limit.

Is written in the state constitution rather than in code.

During this year’s legislative session, a constitutional amendment spending limitation joint resolution was introduced. This measure would “limit the annual increase in spending from year to year to the lesser of 99 percent of the estimated revenue for that fiscal year, or 4 percent above the prior year’s revenue.”

Fiscal analysis of by the Legislative Services Agency (LSA) applied the rules of the resolution to the past twelve legislative sessions and found that,”if the expenditure limitation requirements in SJR 2 had been in place in each of those fiscal years, appropriations to the General Fund would have been lower than the enacted appropriations in seven of the fiscal years.”

If the spending limit had been in place since fiscal year 2009, state government could have spent over $500 million less than it did.

State Senator Charles Schneider has said, “Going into fiscal year 2017, we could have had a carryover surplus of at least $442.8 million. Had that been the case, we would not have had to deappropriate funds for fiscal year 2017, and we would not have to dip into the cash reserve fund to fill the remaining budget gap for this fiscal year.”

Critics of spending limitations argue that they will deprive the state of the ability to fully fund government programs, but even the most stringent state limitations have demonstrated that they did not cut government spending but merely slowed its growth rate. Iowa policymakers should seriously consider a state spending limitation amendment to ensure the taxpayer remains on equal footing with special interests.