What ITR said:

- Establish a reasonable limit, that can be exceeded with the appropriate steps, on how much a city's or county's property tax revenue can increase each year.

- Allow citizens to easily understand how local government budgets will impact their property tax bill.

- Require local governments to cast an affirmative vote on property tax increases.

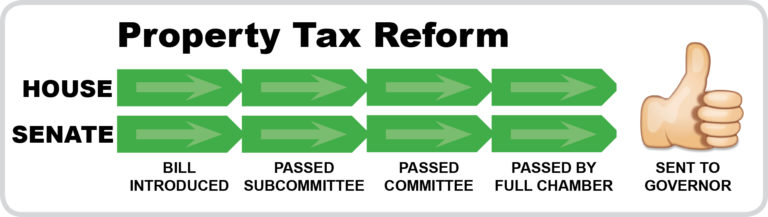

What Happened:

- Success! This bill accomplishes that goal. Transparency, citizen input, and local government accountability will all be increased when Governor Kim Reynolds signs this bill.

Work Left to Do:

- Because this bill focuses on transparency more than hard limits, citizens must engage in the process to control property taxes.

- ITR will keep you informed when cities, counties, and school districts begin local budget discussions.

- It is up to constituents to make local elected officials reconsider sitting back and reaping the windfall of increased assessments.

The Problem:

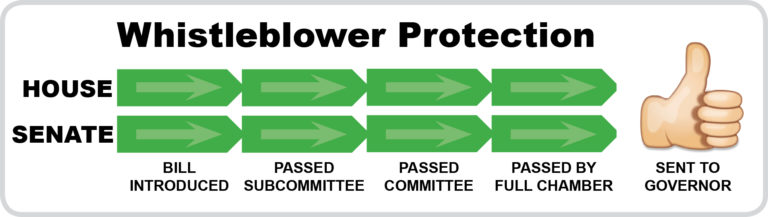

- Fear from the repercussions of reporting wrongful expenditures of public dollars can lead to silence, which may result in the ongoing misuse of tax dollars.

ITR Solution:

- Extend Iowa’s current whistleblower protections to public sector employees who report suspected wrongdoing.

- Mandate training for new public employees on the procedure for reporting.

What Happened:

- A bill was approved by both chambers and sent to the Governor.

The Problem:

Iowa ranks as the 12th most broadly and onerously licensed state, making it one of the worst states for occupational licensing for lower-income workers.

ITR Solution:

Reevaluate and reduce the bureaucratic red tape tax that is job licensing.

What Has Happened:

- A bill was approved by the House

- This bill was introduced but did not advance out of subcommittee

Work Left to Do:

Let your legislators know reducing these barriers can lead to job creation, more entrepreneurial opportunities, lower prices, and increased incomes.

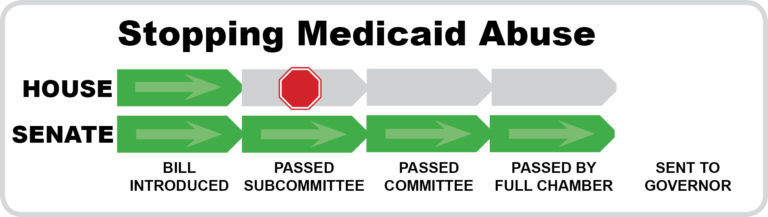

The Problem:

Other states that have implemented Medicaid recipient audits found considerable fraud. Louisiana, for example, randomly checked 100 Medicaid recipients and discovered that 82 of them no longer qualified for benefits. Iowa does not know.

ITR Solution:

- Regularly review recipient eligibility.

- Remove individuals from the rolls who abuse the system.

What Has Happened:

- A bill was approved by the Senate.

- This bill was introduced in the House but not assigned to a subcommittee.

Work Left to Do:

Inform legislators that allowing Medicaid fraud doesn’t just fleece the taxpayer; it is unfair to those Iowans who need the services Medicaid provides.

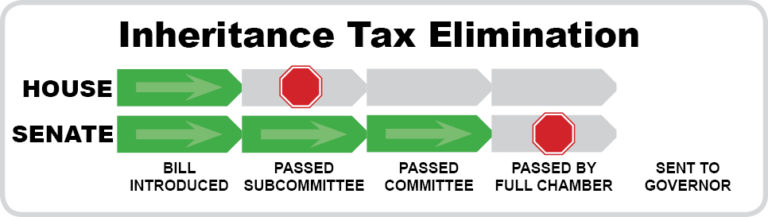

The Problem:

Several years ago, the legislature removed the inheritance tax for lineal relations. Today, if a deceased person does not have children or chooses to leave their assets to a non-lineal relation, this can create a scenario where the beneficiary does not have the liquid assets to pay the inheritance tax, potentially resulting in the sale of a small business or family farm. This is not the outcome tax policy should strive to achieve.

ITR Solution:

Completely eliminate Iowa's inheritance tax.

What Has Happened:

- A bill cleared two hurdles in the Senate.

- A similar bill was introduced in the House.

Work Left to Do:

Contact your legislators and let them know Iowa may be driving the final nail into the heart of the family farm or the family business via the inheritance tax.

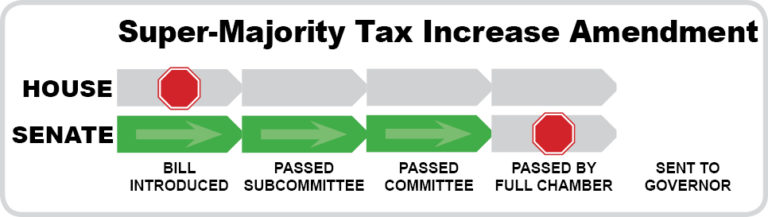

The Problem:

The threshold for raising taxes on hardworking Iowans is too low.

ITR Solution:

Requiring a two-thirds majority vote by the Legislature to raise income taxes is a commonsense protection that puts taxpayers before the noisy special interests that are constantly asking for a bigger piece of their paychecks.

What Has Happened:

A joint resolution advanced through a Senate subcommittee and committee. The House did not take action on this resolution.

Work Left to Do:

Remind legislators who is paying the state's bills (YOU!), and ask for their support for a resolution requiring a super-majority vote to raise your taxes.

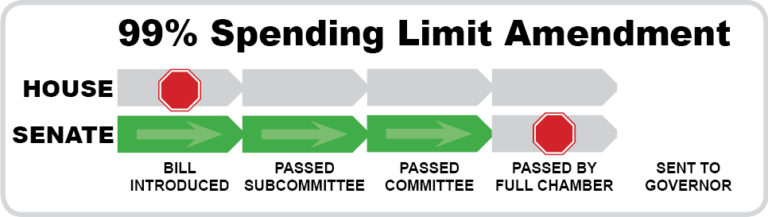

The Problem:

Because Iowa's 99% spending limit only exists as a statute, a future legislature could simply pass a new statute that further weakens this limit or removes it altogether.

ITR Solution:

A constitutional amendment would be the strongest way to control the growth of government and future spending.

What Has Happened:

A joint resolution advanced through a Senate subcommittee and committee. The House did not take action on this resolution.

Work Left to Do:

Tell lawmakers to give Iowa permanent spending protection by supporting the 99% spending limit amendment.

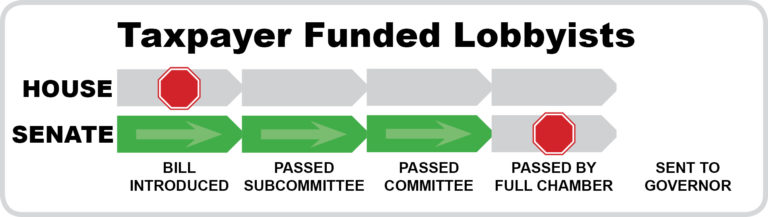

The Problem:

If taxpayer money is being used for lobbying activities, the taxpayers deserve to know exactly how that money is being used.

ITR Solution:

The Iowa Legislature should require disclosure of official public stances cities and counties are taking.

What Has Happened:

- A bill advanced through a Senate subcommittee and committee.

- The House did not take action.

Work Left to Do:

Contact legislators and remind them not to forget taxpayers when funding the desires of government.

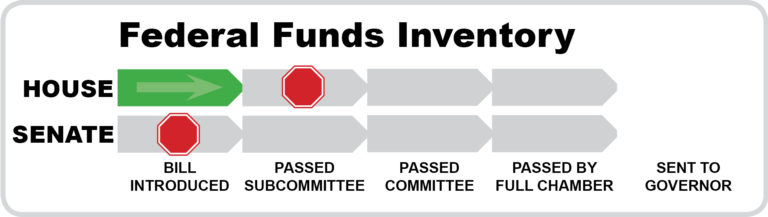

The Problem:

Federal funds could be reduced or eliminated in a flash, such as in the case of a government shutdown. These funds also come with strings attached, often requiring additional state funding to support federal initiatives.

ITR Solution:

- Itemize all federal funds.

- Measure the dollars and obligations.

- Identify the end date.

- Develop a contingency plan.

What Has Happened:

- A bill was introduced in the House and assigned to a subcommittee.

- No action was taken by the Senate.

Work Left to Do:

Tell legislators that Iowa must protect itself from Washington’s mismanagement.

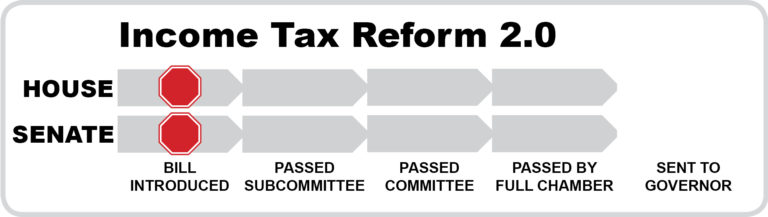

The Problem:

Last year's state income tax reform was a good start. However, Iowa's tax rates remain among the highest in the nation.

ITR Solution:

- All planned future tax cuts should be implemented sooner.

- Legislators should create a path of continued rate reductions for individual and corporate income taxes.

What Has Happened:

- As expected, legislators passed a “clean-up” bill that addresses some technical aspects of 2018’s income tax reform law.

- Additional, substantive reforms were not addressed by either chamber this year.

Work Left to Do:

Remind policymakers that individuals, entrepreneurs, and businesses will vote with their feet by moving to states with the best regulatory and tax climates.