ITR 2024 Legislative Issue Guide

Think back to 2010. Democrats held the state government trifecta. Politically, Iowa’s policy positions were quickly lining up with Illinois.

However, Iowa had real hope and change. In November 2010, Iowans ended the tax-and-spend trifecta by electing Governor Terry Branstad, Lt. Governor Kim Reynolds, and a conservative majority in the Iowa House. Then, in 2016, the control of the Iowa Senate finally flipped.

Immediately, fiscally conservative leaders began enacting free-market, pro-growth reforms.

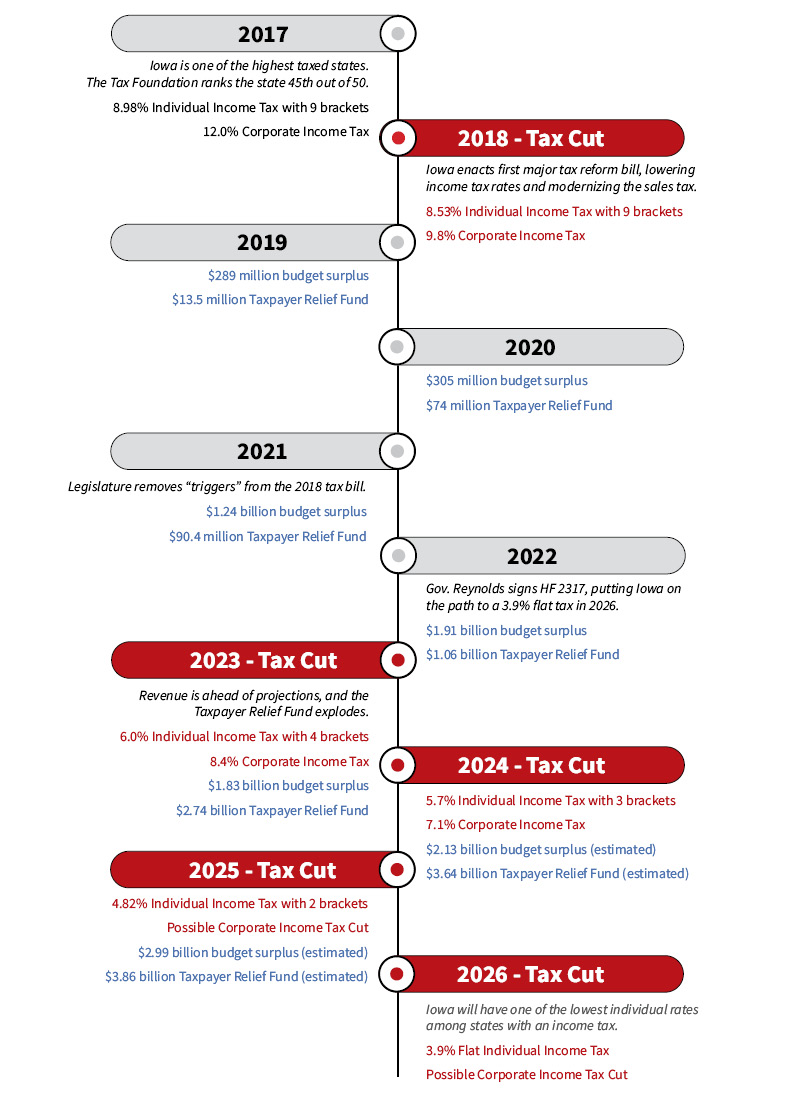

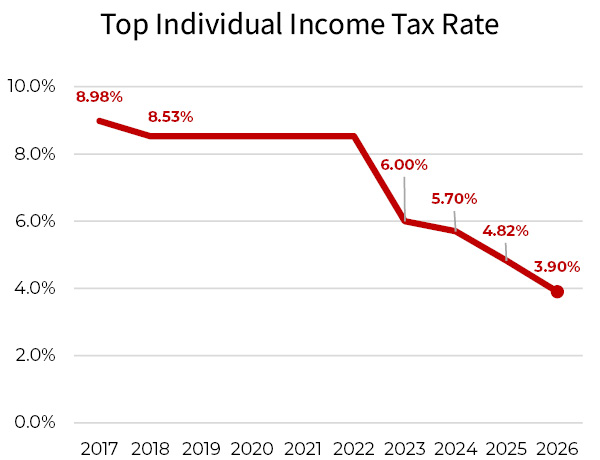

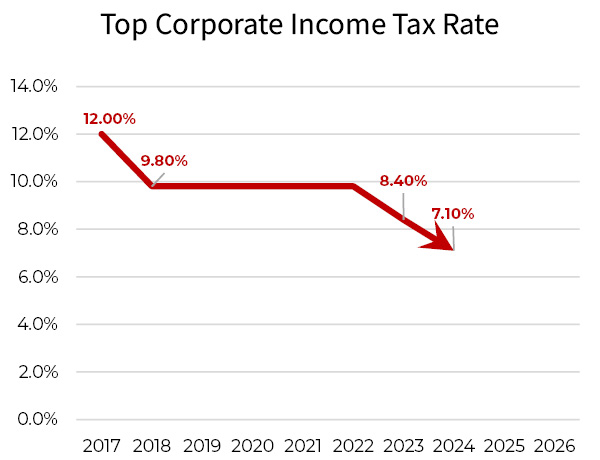

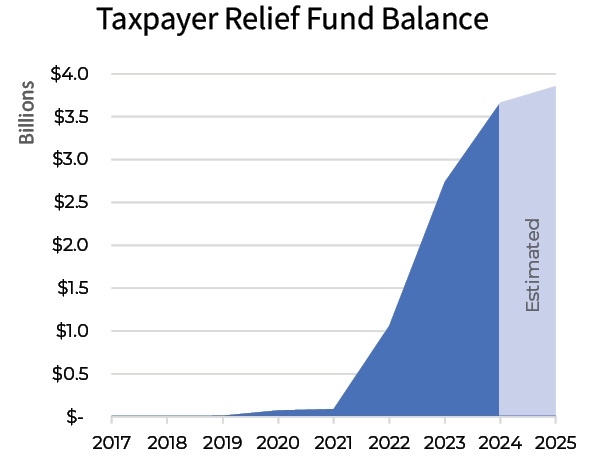

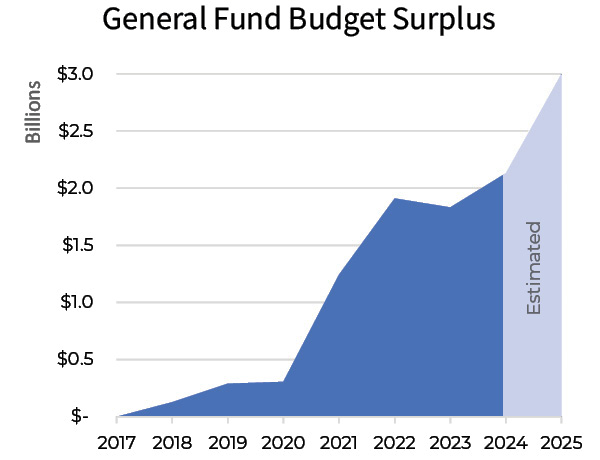

In 2018, Iowa enacted a significant tax reform bill, lowered income tax rates, and modernized the sales tax. Disciplined budgeting led to surpluses, and the revenue triggers included in the 2018 reform were removed in 2021. Then, in 2022, Iowa’s conservative leadership put Iowa on the path to a 3.9 percent flat income tax.

Iowa is setting the gold standard that other states want to follow. However, we must not become complacent. Our state’s tax code must continue to improve, and we must secure our victories for future generations.

Last year’s property tax reform was a good first step. But we can’t stop now. Further reform is needed to address the leading cause of high property taxes. To be clear: the problem is not property assessments; the driving cause is local government spending.

The Iowans for Tax Relief freedom infrastructure is here to help. We will have a strong presence at the Capitol throughout the legislative session, ensuring the voice of the taxpayer is heard every day.

ITR 2024 Legislative Issues: