How Can Iowa Control Property Tax Increases?

This week, ITR sat down with Jared Walczak, Senior Policy Analyst for the Tax Foundation, to discuss what Iowa can do to control property taxes.

Everyone who has looked at their skyrocketing property tax bill in Iowa probably has the same emotion: anger. Walczak said this frustration is rooted in the fact that an increase in the value of property does not change the owner’s ability to pay the tax. As one of our members has written to us, “Just because my house is worth more doesn’t mean I have more dollars in my pocket to pay taxes.”

Some states limit the growth on assessments or valuations. Walzack said this can distort property tax bills even within neighborhoods, with seemingly identical properties having drastically different property tax bills. Artificially capping assessments also creates disincentives for homeowners. Since states with assessment caps typically only revalue properties after a sale, change of use, or substantial improvement, homeowners simply are not willing to move or improve homes in fear of triggering a jump in their tax bill. Unfortunately, this only shifts the tax burden to someone else.

As assessments or valuations rise, property tax increases are on autopilot. We asked Walczak how Iowa can control property tax bills. He recommends a budget or revenue limit; “At a local level, total growth of collections from property taxes can only rise by a certain amount in a given year. It can be a set amount like two percent, or it can be an inflation measure. If local government wants to go beyond it, they can go to the voters and ask for an override.”

Subcommittee Hearing on Property Taxes Scheduled

The Iowa House has scheduled a subcommittee meeting for HSB 165, a property tax reform bill, for 8:00 a.m., Wednesday, March 13. If you would like to attend and speak, please send us an email.

The property tax reforms proposed in HSB 165 will:

- Set a reasonable limit for revenue growth of cities and counties

- Allow an override of that limit by local governments after a transparent process of notifications, public hearings, and vote by elected officials

- Permit citizens to call for a vote of the people if they disagree with the budget passed by their local government

HSB 165 is a step in the right direction to control the growth of property tax bills for all Iowans. It will take property tax increases off of autopilot due to increased assessments.

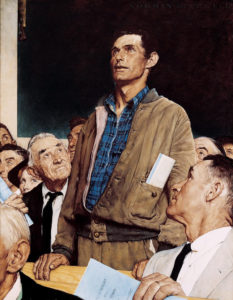

For many Iowans, a property tax bill is nothing short of crushing. Legislators must act, and they need to hear from you, their constituents.

Taxpayer Funded Lobbyists

Taxpayer dollars should not be used for lobbying, and the Iowa legislature should promptly prohibit lobbying and ballot-issue activity by any organization that receives taxpayer dollars.

The Senate State Government committee passed SSB 1229 on Wednesday to expand current limitations on lobbying activities by including all state government entities, as well as local governments.

Many lobbyists who are hired by governments end up advocating to increase governmental powers and/or increase their tax revenues! Governments, at all levels, rarely lobby to reduce themselves, even though families and businesses across Iowa must make difficult financial decisions every day. At the Capitol, taxpayers can too easily end up forgotten and only remembered when it comes time to fund the desires of government. While it is argued that lobbying is a form of free speech protected by the First Amendment of the Constitution, those rights are for citizens and not government itself.

Cutting Bureaucratic Red Tape

HSB 180, an occupational licensing reform bill, was passed out of the House Committee on Labor this week. This bill helps ensure occupational licensing isn’t excessive or overly burdensome. Removing those barriers can lead to job creation, more entrepreneurial opportunities, reduced prices, and increased incomes.

Property Taxes Are Growing Faster than Income

Property taxes were the main topic at the Taxpayers Association of Central Iowa’s (TACI) annual meeting this year.

TACI President Gretchen Tegeler told attendees, “Property taxes are growing faster than household income. This growth eclipses growth in inflation, state tax revenue, and other indicators.”

Polk County Assessor Randy Ripperger warned of a coming tsunami with the next round of property valuations. He also said the rising assessments do not necessarily translate to higher property taxes, IF local taxing entities focus on budget-driven budgets rather than rate-driven budgets.

Jared Walczak, Senior Policy Analyst with the Tax Foundation, thinks people care about their local communities and are willing to pay for them with property taxes, provided local governments are clear about where and why they are using their tax dollars.

Iowa is fortunate to have groups like Taxpayers Association of Central Iowa and we encourage you to join or follow them.

Taxpayer Comments