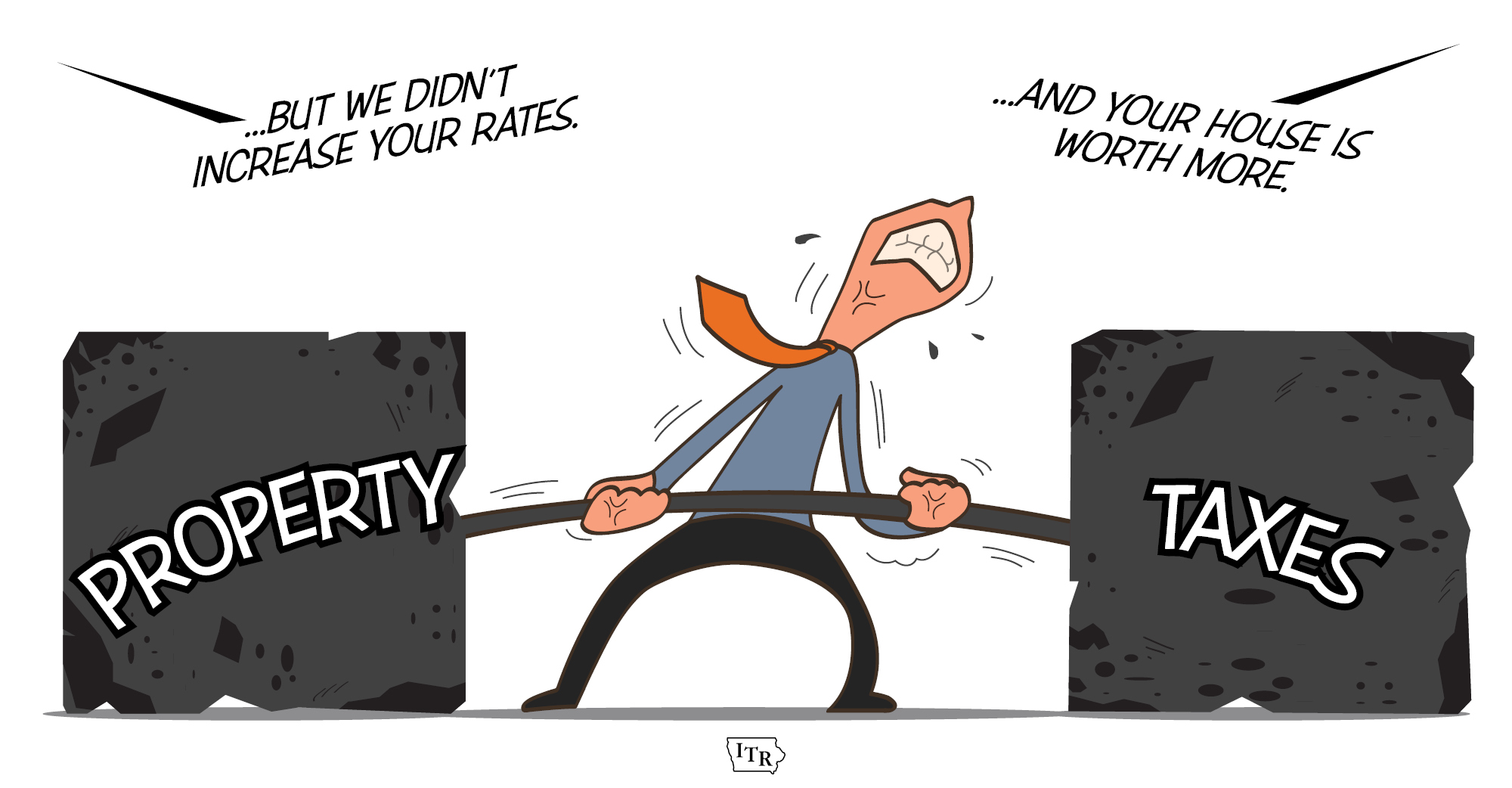

Many local governments (though not all) have a tendency to ride the wave of increased assessments while proudly proclaiming they didn’t raise taxes because they kept the rates the same. It’s simple math that they are denying: The same rate multiplied by a larger assessment equals a bigger property tax bill.

It shouldn't be this way.

Your house increases in value, elected officials pledge to keep the levy the same, but your property tax bill increases.

According to an article in the Des Moines Register, Polk County property assessments will increase an average of 8% this year. This should be good news. Our houses are investments, and we should want them to gain in value.

However, this does not mean homeowners have more money to pay their taxes, nor should local governments view this as an opportunity for an automatic tax increase. The Register states, "Home values in Polk County increased by an average of 8.3% in 2017 and 10% in 2019, while from 2017 to 2019, the county's median household income rose an estimated 2%."

How does that compare with the change in property taxes levied from 2017 to 2019?

- DM Public Schools - 10.3% increase

- City of Des Moines - 12.1% increase

- Polk County - 13.1% increase

Was the increase due to community growth?

Nope. The school and city saw slight decreases in enrollment and population, respectively, while the county grew 2%.

The problem is statewide. Many local governments (though not all) have a tendency to ride the wave of increased assessments while proudly proclaiming they didn’t raise taxes because they kept the rates the same. It’s simple math that they are denying: The same rate multiplied by a larger assessment equals a bigger property tax bill.

The bottom line is local elected officials in too many communities across Iowa are setting budgets that take and spend a larger amount of property tax dollars from households and businesses.

It's not the assessor's fault.

Your local school board, city council, and county supervisors determine how much to spend and ultimately the amount of your property tax bill.

Every dollar they spend was first taken from someone who earned it. When the government grows, spends, and takes from taxpayers faster than population growth and inflation, elected officials need to clearly explain why.

We encourage you to contact your local elected officials. Next year's property tax bills will be determined by the budgets created right now.

Ask them why spending is increasing.

There might be a good reason, or they might not want to make hard decisions. Either way, taxpayers deserve to know.

Don't know who to contact? Click below to send us a message, and we will look them up for you.

Request Your Local Elected Official's Contact Info

Article of Interest:

Increased assessments don't have to mean higher taxes

"With assessments going up, we expect government to adjust tax rates accordingly so property owners don’t have to shoulder this burden on their own." - Telegraph Herald Editorial Board (Dubuque)