The Final Gavel Falls

Where ITR Stood & What Was Delivered

It’s easier for politicians to yield to noisy special interest groups when the taxpayer keeps quietly paying the bills. ITR worked on numerous economic freedom issues at the Capitol and many of you contacted legislators to make your voice heard.

It’s important to remember that the 2019 legislative session was the first session of a two-year General Assembly. This means legislators will be able to pick up where they left off when they come back to Des Moines next January and that many of these issues are simply on hold until next year.

What did they accomplish on behalf of taxpayers?

The Problem:

- "Just because my house is worth more doesn't mean I have more dollars in my pocket to pay taxes." This statement from one of our members highlights Iowa's property tax problem.

What ITR said:

- Establish a reasonable limit, that can be exceeded with the appropriate steps, on how much a city's or county's property tax revenue can increase each year.

- Allow citizens to easily understand how local government budgets will impact their property tax bill.

- Require local governments to cast an affirmative vote on property tax increases.

What Happened:

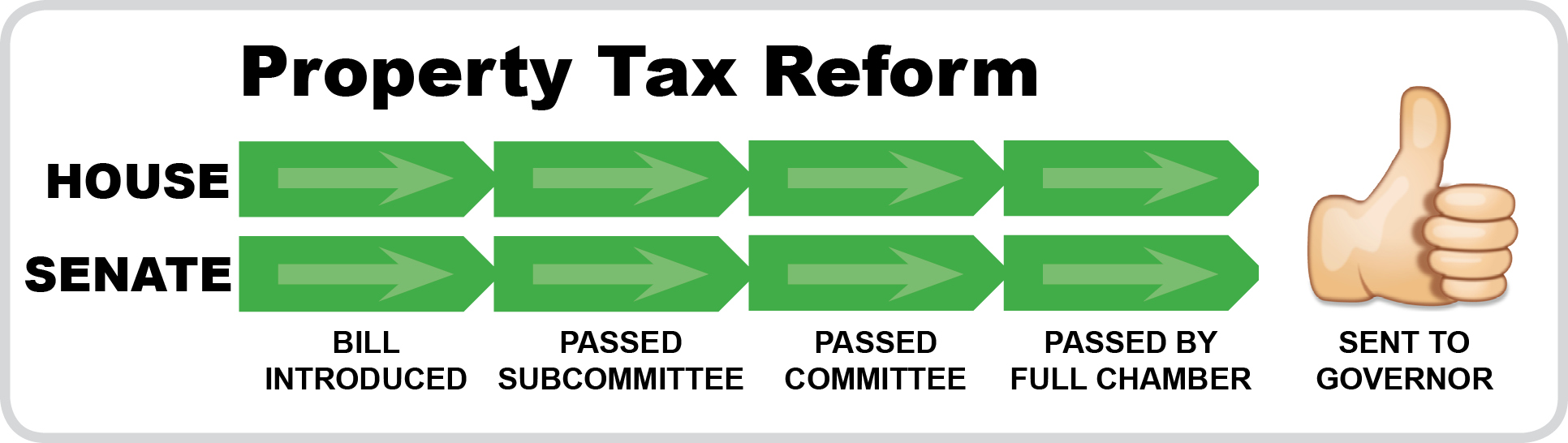

- Success! This bill accomplishes that goal. Transparency, citizen input, and local government accountability will all be increased when Governor Kim Reynolds signs this bill.

Work Left to Do:

- Because this bill focuses on transparency more than hard limits, citizens must engage in the process to control property taxes.

- ITR will keep you informed when cities, counties, and school districts begin local budget discussions.

- It is up to constituents to make local elected officials reconsider sitting back and reaping the windfall of increased assessments.

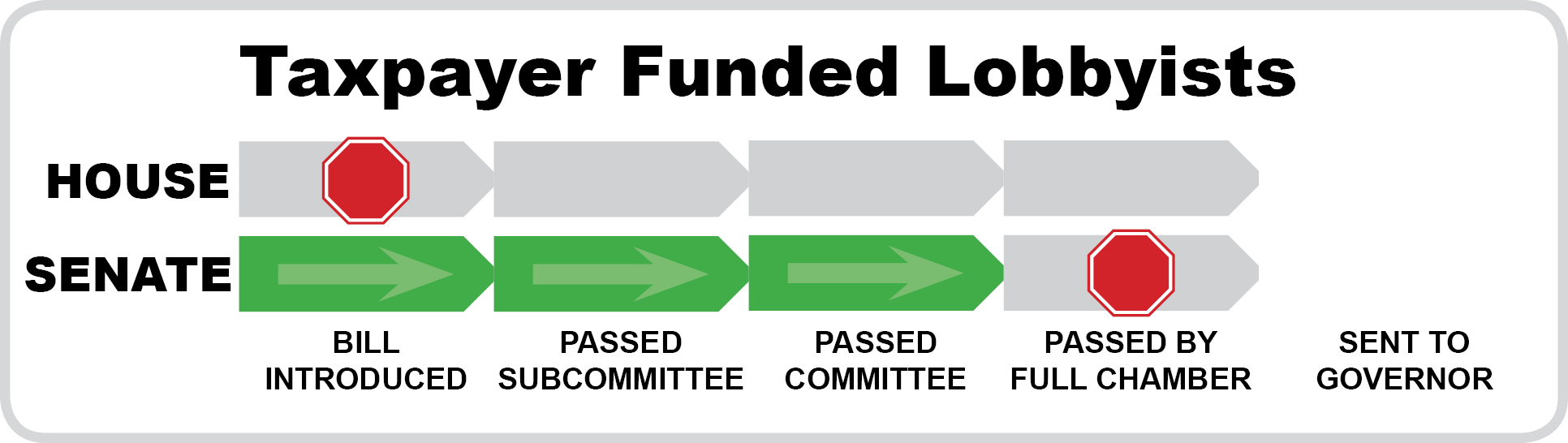

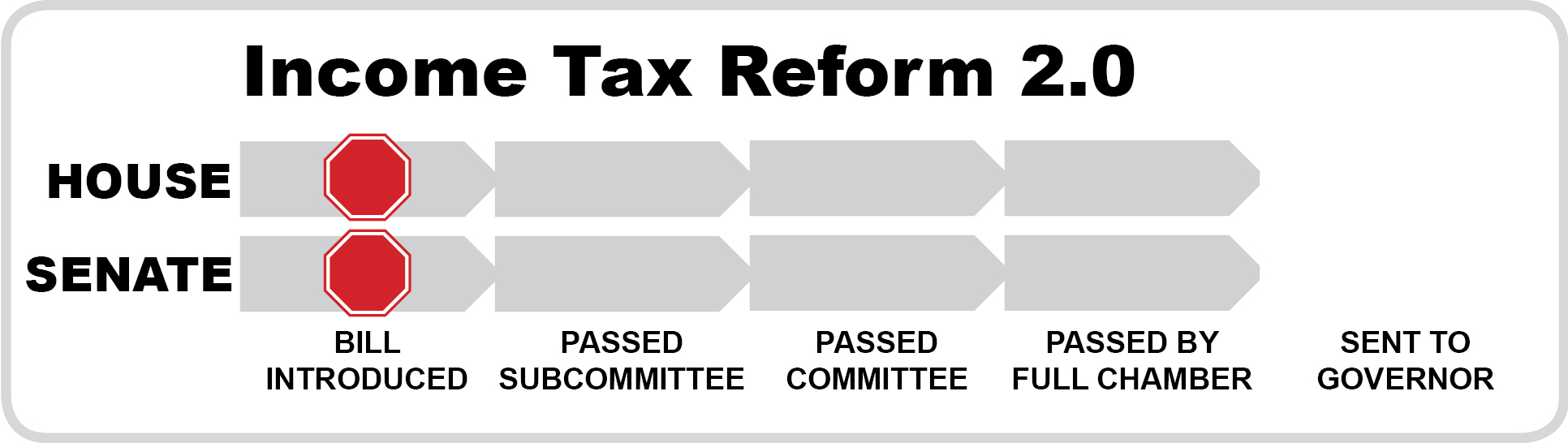

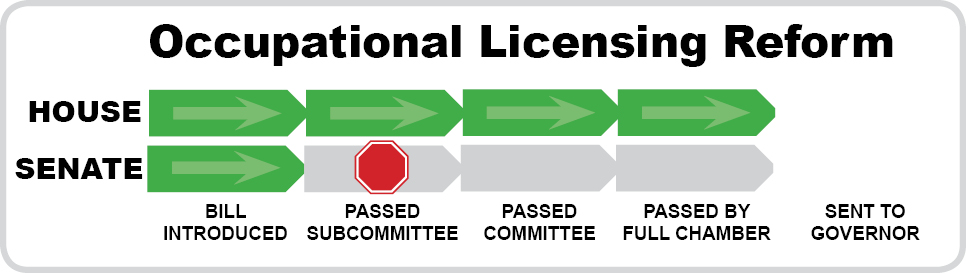

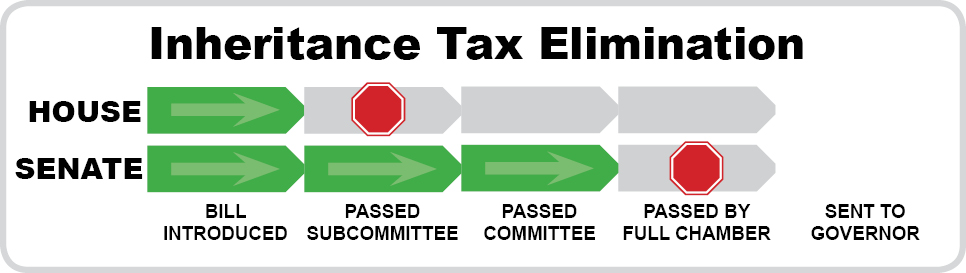

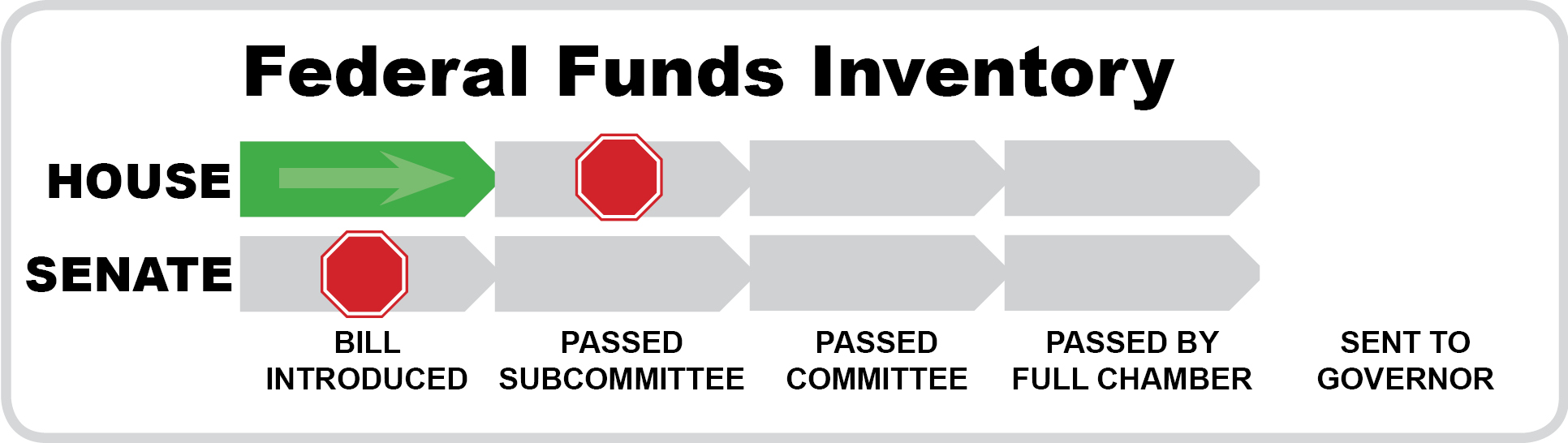

Other Legislative Issues

Click on an issue for more information.