Click the easy button

LEGISLATIVE SESSION

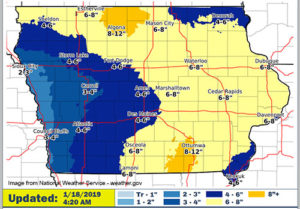

Like the supermarket parking lot ahead of a snowstorm, the legislative parking lot filled with the vehicles of legislators from across the state on Monday as they arrived for their first day of this legislative session.

Lawmakers got right to work and outlined their vision for the session. Some notable comments from lawmakers this week were:

“We need to find ways to continue to reduce the tax burden on hardworking Iowans – particularly when it comes to property taxes.”

– Iowa Senate President Charles Schneider

“We will continue to deliver bold action to build our workforce, continue to reduce taxes, and reduce government dependence in our state.”

– Iowa Senate Majority Leader Jack Whitver

“Iowans expect us to be responsible stewards of their hard-earned tax dollars.”

– Iowa House Majority Leader Chris Hagenow

“We want to be viewed, in the future, as a low tax state.”

– Speaker of the Iowa House Linda Upmeyer

These are great comments, but not everyone at the Capitol agrees. Some openly want to increase taxes and spending. The lobby is full of money-hungry special interests fighting for their piece of Iowa’s budget. ITR will continue to represent the source of that budget: the taxpayers.

Governor Kim Reynolds got right to work and proposed a $7.6585 billion General Fund budget for FY 2020. This would be just a 0.51 percent increase in spending over her revised FY 2019 budget. This proposal would spend 97.36 percent of the on-going revenue for the General Fund, which is below the 99% spending limit.

We look forward to working with the Governor and legislators to increase economic freedom for all Iowans.

ON AIR

ITR President Chris Ingstad was interviewed on multiple radio stations this week, 99.3 FM The Truth in Des Moines and KLMJ/KQCR in Hampton.

When asked about property taxes, Ingstad said, “Since 2000, local government spending is up over 100 percent. GDP in Iowa over that same time is up about 40 percent; inflation is about 50 percent. If you measure what the state itself spends, it is about 60 percent. Local government is outpacing it all.”

Well said! A video of the entire interview on The Truth has been posted on the ITR Facebook page.

TAKE ACTION

Are you frustrated with your ever-increasing property tax bill? Do you think state government spends too much? You need to tell someone–specifically the Governor and your legislators. This is your money and your government!

It’s not hard. Just click this easy button:

Enter your message, email address, and mailing address and our system will look up the email addresses of your elected officials. You just need to click “send.”

Last week we detailed five economic challenges facing Iowa:

- High property taxes

- Reliance on federal funds

- An uncompetitive state tax code

- Potential eligibility abuse within the Medicaid system

- Out-of-control government spending

Seriously, let them know what matters to you. They need to know you are watching and that you expect results this year. Click here to send a message.

TAX QUIZ

Which taxing authority will collect the largest percentage of property taxes statewide in FY 2018-2019?

A. Cities

B. Counties

C. K-12 Schools

(Answer located at bottom of this page)

THIS WEEK’S LINKS

ITR ISSUE – State Government Spending

Let’s spend more on mental health, rural Internet, housing – DM Register

More education, workforce funding – QC Times

Fulfilling public universities funding ask – CR Gazette

ITR Solution – Strengthen Iowa’s government spending limit.

ITR ISSUE – Dependence on Federal Funds

How will Iowa feed 335,000 facing loss of food stamps? – DMR

ITR Solution – Protect Iowa from Washington’s mismanagement.

ITR ISSUE – Legislative Session Goals

GOP lawmakers eager to push ahead on conservative goals. – AP

ITR Comment – Taxpayers have goals too! Read ours here.

QUIZ ANSWERS

C. K-12 Schools

Taxing Authority – Percent

K-12 Schools – 41.47%

Cities – 29.06%

Counties – 21.95%

Community Colleges – 2.80%

County Hospitals – 2.10%

Assessors – 1.00%

Townships – 0.63%

Ag Extension – 0.41%

Other – 0.58%

Source: Iowa Department of Revenue

The content of this page was originally included in our weekly email newsletter, The Watchdog. Sign up to stay informed about all tax issues facing Iowa taxpayers.

It’s easier for politicians to yield to noisy special interest groups when the taxpayer keeps quietly paying the bills.