Many banks will start by charging more for credit cards and eliminating "no fee" credit cards that many consumers enjoy. It doesn’t take long for regulations to show what they really are: a hidden, red tape tax.

Last year, Iowans favored sending Republicans to Washington, giving majority votes to Donald Trump for president, Joni Ernst for senator, and handing three of our state’s four congressional districts to Republicans. Now, those concerns about Democratic control in Washington appear to be well-founded, as leading Democrats are looking to impose what could be one of the largest and costliest regulations in American history.

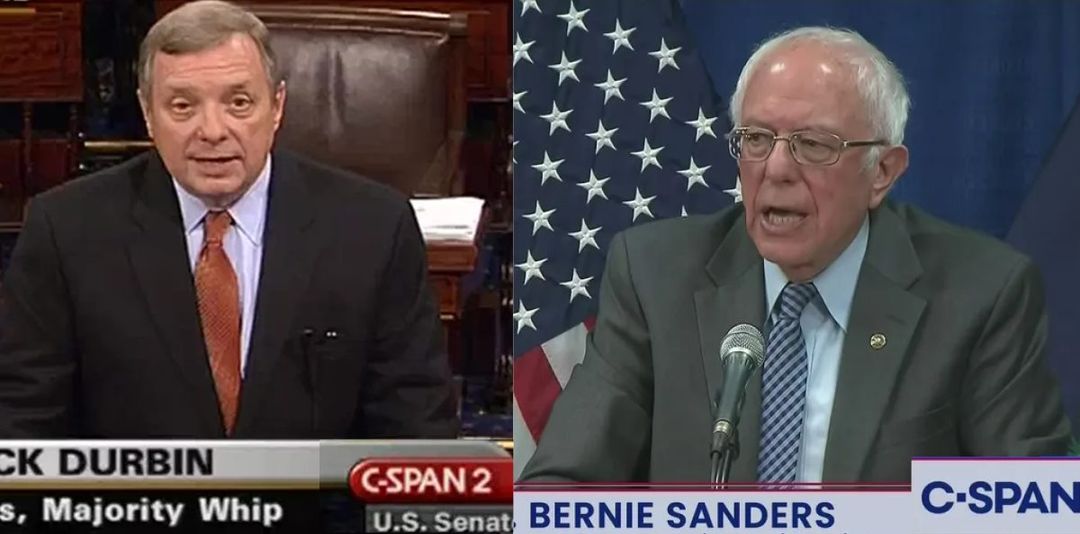

The policymakers behind this plan are Iowa’s neighboring senator, Dick Durbin of Illinois, and liberal champion Sen. Bernie Sanders, the Vermont independent. Progressives are looking to create new regulations on credit cards that would make it more difficult for Iowans to access banking and financial services.

Durbin and Sanders are seeking to place big government price controls on credit cards. While this may sound appropriately "progressive," such a policy ignores the real-world impacts that would be felt by many Americans.

Placing arbitrary limits on credit card pricing would constrain banks from getting the money they need to ensure security and financial inclusion in the digital marketplace. Think of it this way: When a credit card transaction is fraudulent, it is not the customer or the store that typically pays the price. It is the bank issuing the credit card that absorbs the loss. That money has to come from somewhere.

By placing new restrictions and regulations on credit cards, banks will have to limit their credit exposure. Many will start by charging more for credit cards and eliminating "no fee" credit cards that many consumers enjoy. It doesn’t take long for regulations to show what they really are: a hidden, red tape tax.

Consumers will see other limitations on their credit cards too. The average consumer receives nearly $170 in credit card rewards per year. In total, Americans enjoy between $40 billion to $50 billion annually from these types of rewards. But under the Durbin-Sanders proposal, those rewards will likely decline quickly.

The most frustrating aspect of this proposal is that we don’t have to look into a crystal ball to see what will happen; we need only look to the past.

Ten years ago, Durbin championed a similar policy that imposed restrictions on debit card transactions, which unfortunately became law. The result has been bad for American consumers, not the banks it was allegedly targeting.

A Federal Reserve study has found that the Durbin policy led to a 35% decline in the availability of free checking accounts at the banks targeted by the policy. Another Boston University study found that these regulations have cost low-income consumers roughly $160 per year and increased the number of Americans without a bank account by nearly a million.

What liberal lawmakers never seem to understand is that raising the cost of something limits its availability. Iowans don’t want more expensive banking and credit cards. Under the Biden administration, we can’t afford it.

In just the first eight months of Democrats controlling Congress and the White House, Iowans are paying more for gas, more for housing, and more for consumer goods, which have risen in price by 5.4% over the past year.

At a time like this, the last thing Iowans need is to pay more for their banking and credit cards. This is yet another costly liberal policy solution that puts government in the way of our free-market economy. With Democrats having a narrow margin in the U.S. Senate, we have to hope that our senators, Chuck Grassley and Joni Ernst, will join their colleagues in opposing this expensive and pointless regulation.

This article was published as a guest column by ITR Vice President Chris Hagenow in the Des Moines Register and Cedar Rapids Gazette.